15 Vs. 30 Year Mortgage

AnnieMac Education Center

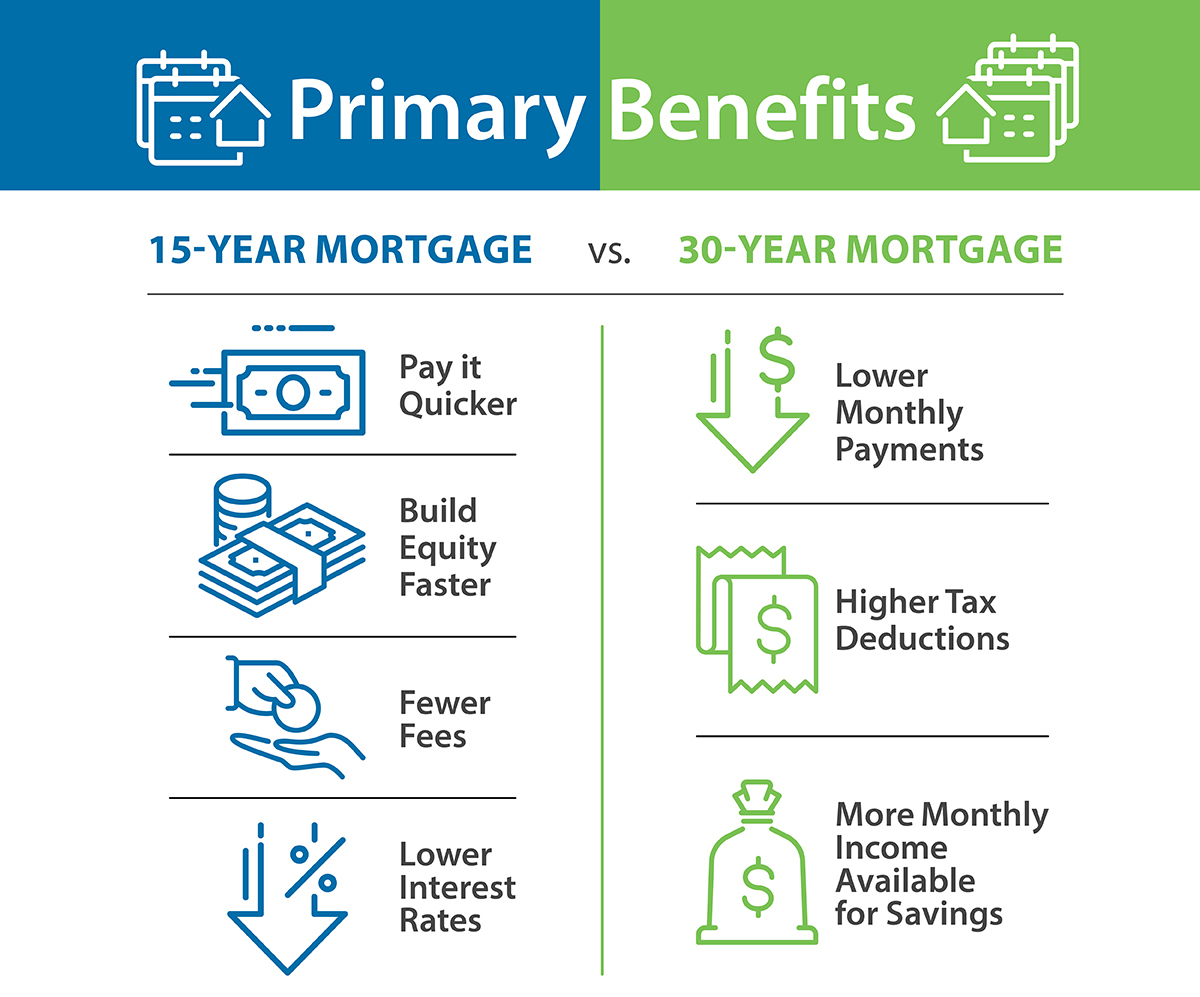

During the homebuying process, borrowers will have to choose between a 30-year fixed-rate mortgage or a 15-year fixed-rate mortgage. Most borrowers choose a 30-year fixed-rate mortgage, but there are many times where a 15-year loan is the best option.

Which Mortgage is the Best for You?

This decision depends on a few factors including your current financial situation, life goals, and what you can currently afford. For many homebuyers, a 30-year fixed-rate mortgage is the ideal option. This is because it allows for more affordable monthly payments.

The downside of this type of mortgage is that it can take longer to accumulate equity and pay off your loan. Therefore, some borrowers choose a 15-year fixed-rate mortgage instead of the 30-year.

The benefits of this type of loan are that you pay much less in interest over the life of the loan, and you grow home equity at a faster rate.

The downside of this mortgage is that monthly payments can be much higher. Many homebuyers cannot afford a higher monthly payment and that is why so many choose the 30-year mortgage.

The right mortgage for you depends on your monthly budget as well as your age, earnings, savings, and financial goals. You can always choose to take out a 30-year mortgage and refinance to a 15-year term or make extra payments on your principal balance.

If you stick to a disciplined and accelerated payment schedule, you could potentially pay off your 30-year mortgage loan in 15 years or less.

If you are conflicted about which option to choose, talk to your loan originator, and compare the costs of both loan types. They will help you determine which loan is best for your financial situation.